Is it fair that businessmen who fail in neighborhood stores have to close shop and often sell their homes, while Wall Street titans are spared the consequences of monumental stupidity and greed?No, it is not fair. Yet, Treasury’s Hank Paulson may be right. To save the sheep who might have been wiped out in a general financial panic, we may have to save the pigs.

Life is unfair, said JFK.

Yet, this is going to be the mother of all bailouts. Paulson will be voted by Congress authority to spend $700 billion, 5 percent of our gross domestic product, to buy all that toxic paper stinking up the books of our biggest banks.

And this is not the first such bailout of foolish and incompetent financiers and politicians.

In 1975, when its cravenness to extortionate union demands had bankrupted New York, the Big Apple had to be rescued by Gerald Ford.

Marion Barry’s Washington, D.C., was next in line at the cashier’s window.

In the Reagan era, it was Chrysler. Later that decade, Citibank, Chase-Manhattan and Bank of America were staring into the abyss, as Latin American regimes, to whom they had lent scores of billions, were balking at paying their debts. Uncle Sam stepped in.

Then came the Mexican and Asian financial crises and the U.S.-IMF bailouts of the 1990s. The Mexican bailout was as much a rescue of Goldman-Sachs as Mexico City, as Treasury Secretary Bob Rubin’s old firm was choking on all its Mexican paper.

The great myth is that these 1990s bailouts were models of U.S. financial statesmanship and great successes. The reality is the U.S. workers took it in the neck.

For the countries bailed out, like Mexico, Thailand, Indonesia and South Korea, were forced to devalue. This radically reduced the wages of their workers relative to American workers, creating incentives for U.S. manufacturers to shut plants here and move them abroad. The devaluations also slashed the price of foreign goods relative to U.S. goods. Imports flooded in.

Who ultimately paid for the Mexican bailout? Florida tomato growers wiped out by Mexican producers, the price of whose tomatoes was chopped two-thirds by the devaluation. U.S. autoworkers who saw Ford and Delphi plants shuttered as new Ford and Delphi plants opened in Mexico. U.S. textile workers whose mills closed and jobs vanished.

Middle-class American families have paid and paid — in lost jobs, lower wages, a falling median income — to save the big banks from the consequences of their follies. And those bank bailouts are behind the trade deficits that set five records in the Bush era, reached 6 percent of GDP, forced huge U.S. borrowings from abroad and ravaged the dollar.

Having bailed out Latin America, Mexico, Asia and their U.S. creditors, we now find our own country in trouble. And how are our allies reacting?

“Europeans on left and right ridicule U.S. money meltdown,” ran the Los Angeles Times headline. Italy’s finance minister compares us to corruption-ridden Albania, where “a nationwide pyramid scheme cost hundreds of thousands of people their savings and ignited anarchic civil conflict” in the 1990s.

How will the bailout work? Will every bank that brings in toxic paper be able to dump it on the Treasury? Will the Treasury buy securities based on subprime U.S. mortgages from foreign banks? Apparently so. What about mortgage-backed securities held by U.S. companies and individual investors? Is there to be a general amnesty for bad judgment, or just a bankers amnesty?

About one thing we may be sure. The U.S. deficit and national debt are going to soar. The credit rating of the United States, as this nation of non-savers has to borrow abroad to save its banks, and their banks, is going to fall. We are going to be a poorer nation and people.

As for the promises and plans of Barack Obama and John McCain — be it for national health insurance or middle-class tax cuts — they are going by the wayside. For the United States is as bankrupt as Lehman Brothers, with this difference: Uncle Sam can still borrow from abroad because foreigners see many juicy U.S. assets they would like to take off our hands with their hoards of ever-cheapening U.S. dollars.

Looking at the federal budget — the five or six major items are Social Security, Medicare, Medicaid, defense and interest on the debt. All are going up, as tax revenues fall. Add the cost of two wars and a bailout of U.S. banks that some estimate will cost $1 trillion to $2 trillion, and we appear to be looking at budget deficits ad infinitum.

“There is a great deal of ruin in a nation,” Adam Smith once consoled a friend who lamented that Britain would be ruined if the 13 Colonies were lost.

We are about to test Smith’s proposition.

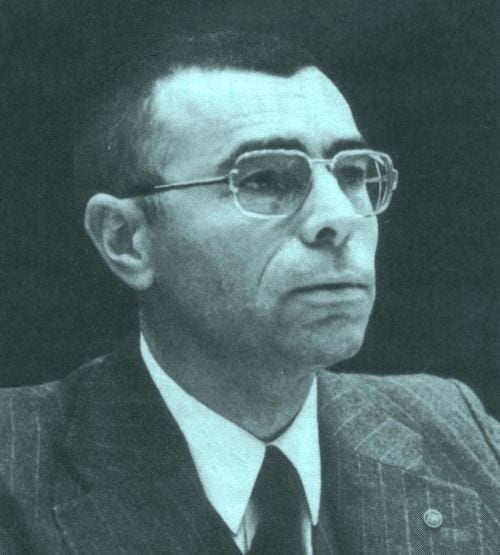

Originally posted on Patrick Buchanan´s site.

Jsme predátorskou civilizací a žvaníme o lidských právech

Jsme predátorskou civilizací a žvaníme o lidských právech Autor: Alberto Lombardo

Autor: Alberto Lombardo Autor: Anthony Hilton

Autor: Anthony Hilton Autor: Ryszard Legutko

Autor: Ryszard Legutko Autor: Michal Kesudis

Autor: Michal Kesudis Autor: William S. Lind

Autor: William S. Lind Autor: Redakce

Autor: Redakce Autor: Guillaume Faye

Autor: Guillaume Faye

***

*** 28. května 1934

28. května 1934

Nejnovější komentáře